The uncertain future of our national economy has created some real, tangible fears for many Americans. But unlike many major industries, civil construction has reason for hope, according to Brian Moore, a partner with Fails Management Institute (FMI).

Moore recently moderated each of the 2023 Learn+Earn events, half-day educational sessions hosted annually by Emery Sapp & Sons (ESS). He delivered a keynote address that covered a variety of market topics, including a comprehensive economic analysis of the major segments that form the construction industry, such as urban mass transit, food and beverage, life sciences, and new energy.

“From infrastructure to housing, what and how we consume, produce, and tolerate drives what products get built,” he said.

Societal and environmental changes, he explained, directly impact consumer and construction demands. And because nearly 90% of the U.S. population now resides in urban areas, revenue from residential construction has drastically declined. In 2022, residential projects lost 6% of revenue while nonresidential projects profited 22%. As communities transition from suburban to urban life, Moore anticipates the revenue loss in this sector to continue.

“When you look at individual segments of construction, our expectations are in the next several years that you’ll see significant declines in single-family residential construction for a host of reasons — high interest rates being a big part of that,” he said. “We see significant drop-offs in certain types of construction.”

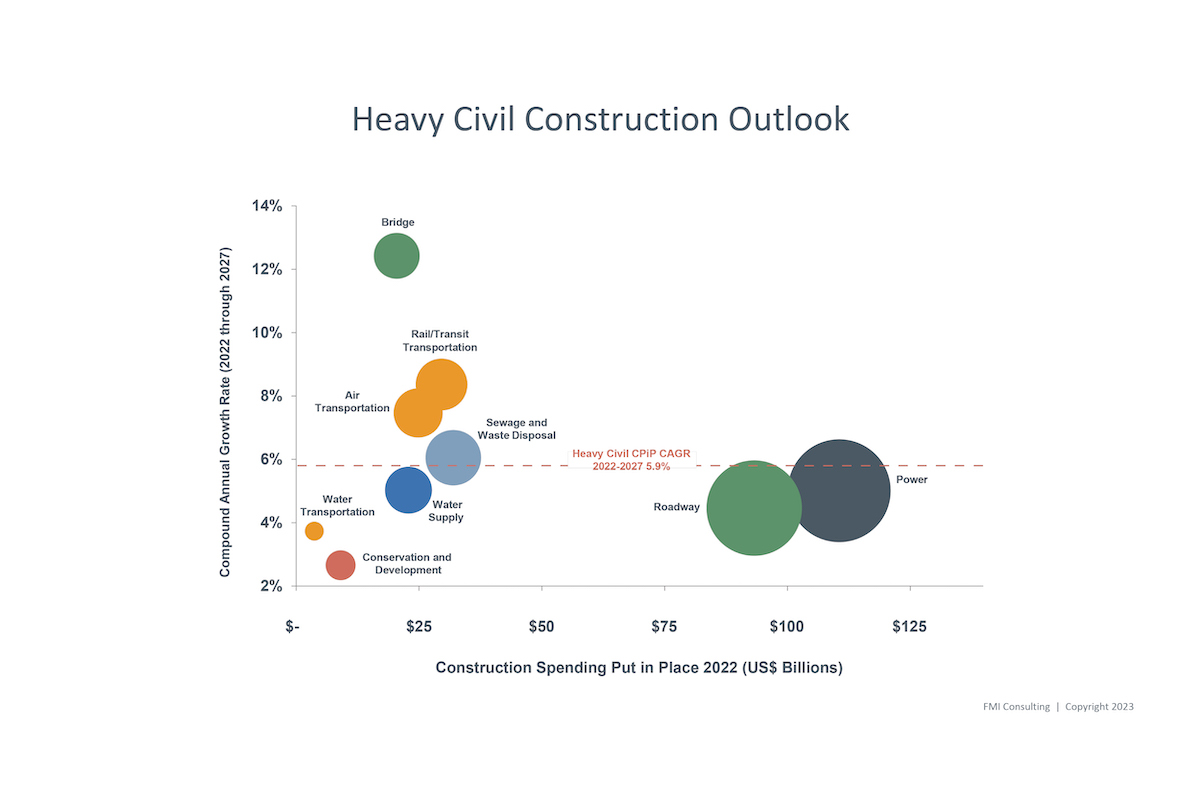

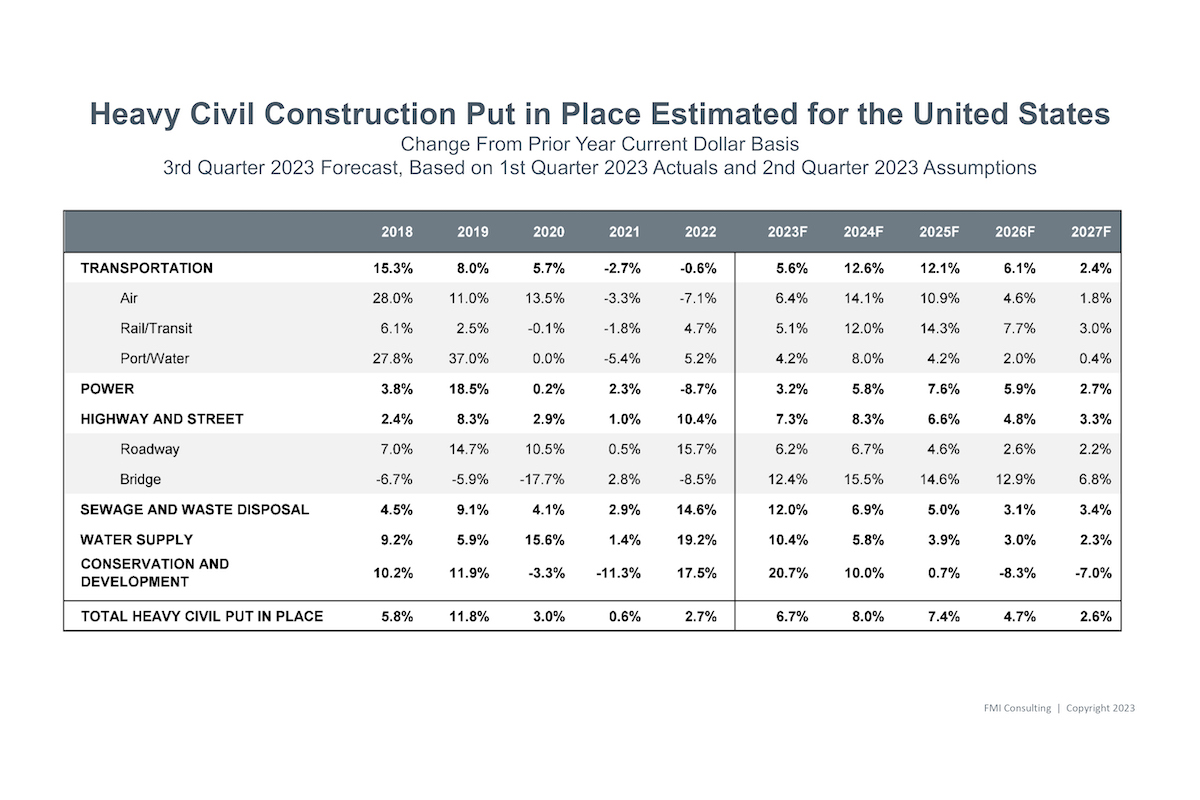

However, the continued demand for heavy civil construction is being driven by several key reasons: The increase in urban density has highlighted the risk of shared power grids, which has driven the need for more reliable energy. In fact, power consumption has more than doubled in the last four decades. To facilitate this growth, investments in public transportation and new energy infrastructure are expected to increase by double digits in the coming years.

In addition, the number of connected devices in the U.S. has tripled since 2018, which has led to an increased need for additional data processing and storage centers — especially for the more than 50% of Americans working remotely (up from less than 5% prior to the pandemic). This industry has witnessed tremendous technological growth and can only expect to encounter more in the years to come.

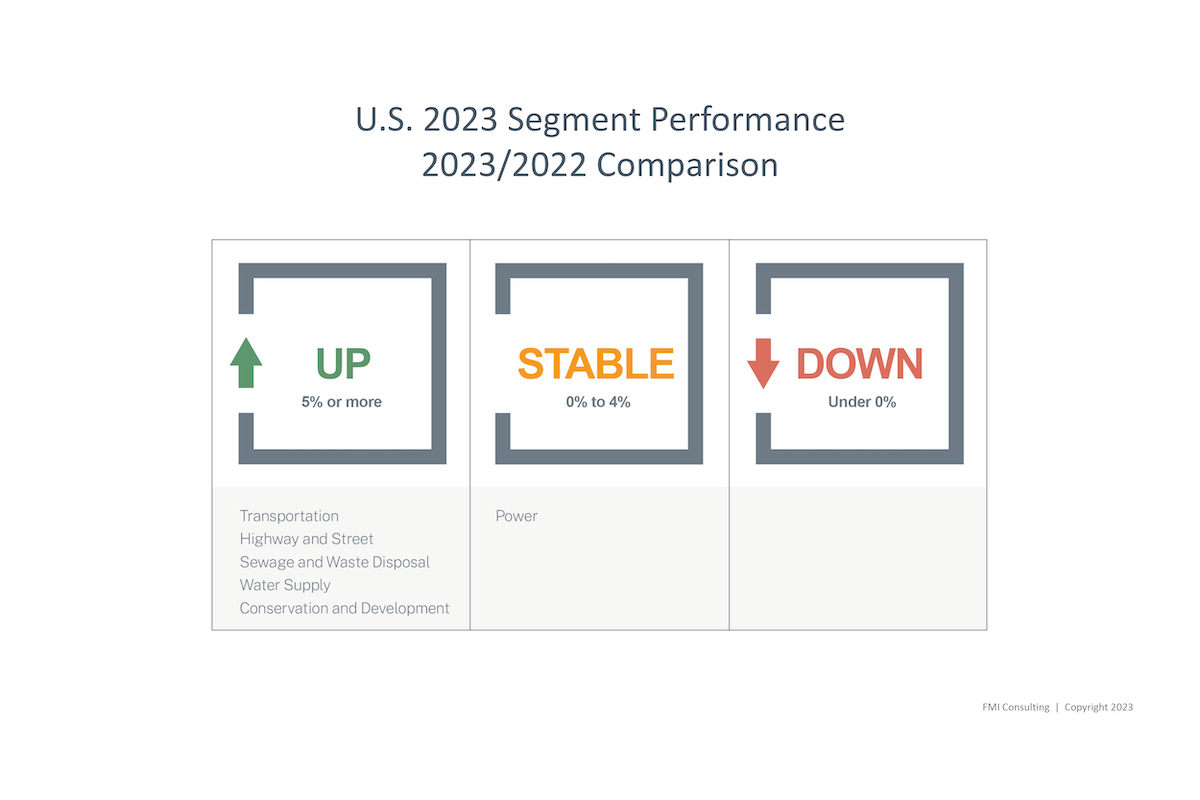

Of the six major industry segments observed by FMI, five experienced at least 5% growth over the last 12 months. Investments in conservation and development increased more than 20% in 2022 and are expected to continue leading the industry.

The main takeaway? Moore said the future of heavy civil construction looks bright:

“Twenty years ago I made the decision to work with heavy civil contractors, and it’s finally paying off,” he said. “Our expectation for heavy civil infrastructure construction forecast for the next decade is as good as it has ever been.”

Photos provided by FMI Consulting.